"ITC's Sustainable Symphony: Orchestrating Value Creation through the Value Octagon"

"ITC's Sustainable Symphony: Orchestrating Value Creation through the Value Octagon"

In the dynamic landscape of the corporate world, ITC Limited stands out not just as a conglomerate with diverse business interests but as a beacon of sustainable and responsible corporate behavior. At the heart of ITC's success lies a strategic approach rooted in the Value Octagon framework, a comprehensive model that encapsulates various facets of value creation. In this blog post, we delve into how ITC harmonizes its strategy and operations with the Value Octagon, encompassing key areas such as strategy and business model, capital allocation, strategic financing decisions, organizational architecture, cost management, corporate risk management, mergers and acquisitions, and corporate governance.

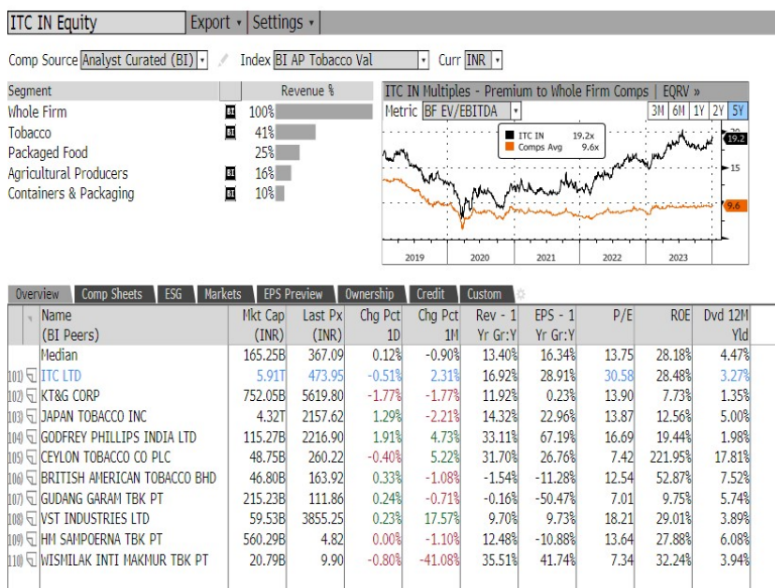

Strategy and Business Model: ITC's business model is a testament to the versatility of the Value Octagon. With diversified interests spanning FMCG, Agribusiness, Paperboards & Packaging, Hotels, and Information Technology, ITC seamlessly integrates its strategic fit within the Value Octagon. This diversification aligns with the principles of the framework, allowing ITC to leverage core competencies and create synergies across various sectors.

- Sustainability takes center stage in ITC's strategy, evident in initiatives like e-Choupal and a robust commitment to environmental stewardship. The agri-sourcing program directly engages with farmers, promoting sustainable agricultural practices, aligning perfectly with the environmental impact dimension of the Value Octagon.

- Innovation is a constant in ITC's approach, with continuous investments in technological capabilities. This aligns with the technological capabilities dimension of the Value Octagon, showcasing ITC's commitment to efficiency and competitiveness.

- Market positioning and brand building are strategic pillars for ITC, exemplified by the creation of strong brands like "Classmate," contributing to the company's market position in education and stationery. These strategies align with the market position dimension of the Value Octagon.

- Social impact initiatives, such as agribusiness programs, underscore ITC's commitment to positive societal value, in harmony with the social impact dimension of the Value Octagon.

- Strategic alliances and collaborations, particularly in the IT sector, enhance ITC's competitiveness and resilience, echoing the technological capabilities dimension of the Value Octagon.

- Corporate governance practices at ITC align with the governance dimension, fostering transparency, ethical conduct, and accountability. This commitment is essential for building trust among stakeholders and supporting long-term value creation.

- Financial performance at ITC is underpinned by a value chain integration strategy, aligning with the financial performance dimension of the Value Octagon.

Capital Allocation: ITC's capital allocation strategy seamlessly aligns with the Value Octagon, showcasing a comprehensive approach to value creation. The company allocates capital to sustainable ventures, research and development for technological innovation, diversification into new markets, brand building, environmental sustainability initiatives, and community development programs. This strategic approach ensures a balance between growth investments and returning capital to shareholders, contributing to both financial performance and governance aspects of the Value Octagon.

Strategic Financing Decisions: ITC's creditworthiness and strategic financing decisions reflect a symbiotic relationship between responsible corporate behavior and financial strength. With a stable ESG rating and a coveted "AAA" credit rating from CRISIL, ITC's commitment to sustainability actively influences its strategic financing decisions. By addressing environmental and social risks, particularly through initiatives like water conservation, ITC enhances its resilience against challenges, reinforcing its credit profile. The positive correlation between ESG performance and investor appeal strengthens ITC's access to capital, showcasing how sustainable practices contribute to financial resilience. ITC's ESG integration within creditworthiness evaluation and strategic financing decisions aligns seamlessly with the Value Octagon, positioning it as a responsible and resilient corporate entity.

Mergers and Acquisitions: ITC's commitment to sustainability extends to its M&A decisions, integrating environmental and social impact considerations. Examples include the acquisition of a food processing company in 2017, emphasizing sustainable sourcing practices, and the restructuring of the paper business in 2018 to enhance efficiency while maintaining a sustainable approach. Additional instances, such as the acquisition of Sunrise Foods in 2020, Technico Agri Sciences in 2011, and Wills Sport in 2000, as well as the merger of ITC Infotech with ITC Limited in 2001, underscore ITC's commitment to creating shareholder value through strategic M&A activities. These instances exemplify how ITC's M&A decisions align with the environmental, social, and strategic fit dimensions of the Value Octagon.

Organizational Architecture: ITC's organizational architecture is intricately aligned with the Value Octagon, emphasizing the integration of sustainability and responsible business practices. Key features include dedicated sustainability committees and teams, cross-functional collaboration, top-down commitment from leadership, performance metrics tied to sustainability goals, and transparent reporting mechanisms. This organizational architecture ensures that ITC's commitment to value creation extends beyond financial metrics to encompass environmental and social impacts.

Cost Management: ITC employs various cost management strategies to enhance efficiency and profitability within its operations, aligning with the Value Octagon. Initiatives include supply chain optimization, operational efficiency through automation, waste reduction, value engineering, cost control programs, and employee empowerment. These efforts collectively showcase ITC's commitment to cost management across diverse business segments, contributing to its overall value creation strategies within the Value Octagon.

Risk Management: ITC's commitment to risk management and corporate governance reflects a strategic alignment with the Value Octagon framework, emphasizing holistic and integrated approaches to ensure enduring value creation. In terms of risk management, ITC's stable management team plays a pivotal role in integrating risk mitigation across various facets of the Value Octagon, including financial performance, market position, environmental and social impacts, and governance. This cohesive leadership ensures that risks are addressed comprehensively, contributing to the company's resilience in the face of evolving challenges.

Environmental and social risk mitigation is deeply ingrained in ITC's sustainability initiatives, with a consistent leadership facilitating the implementation of sustainable practices to reduce the company's environmental footprint and address social concerns. This aligns not only with the environmental and social impact dimensions of the Value Octagon but also ensures long-term resilience against evolving environmental and social challenges.

Corporate Governance: On the corporate governance front, ITC's ethical business conduct and strong reputation for governance practices align seamlessly with the governance dimension of the Value Octagon. The continuity in leadership fosters a culture of responsibility, adaptability to changing business dynamics, and a commitment to enduring value creation for both shareholders and broader stakeholders. Effective board oversight, transparent reporting mechanisms, and stakeholder engagement platforms further reinforce ITC's commitment to creating sustained value within the principles of the Value Octagon.

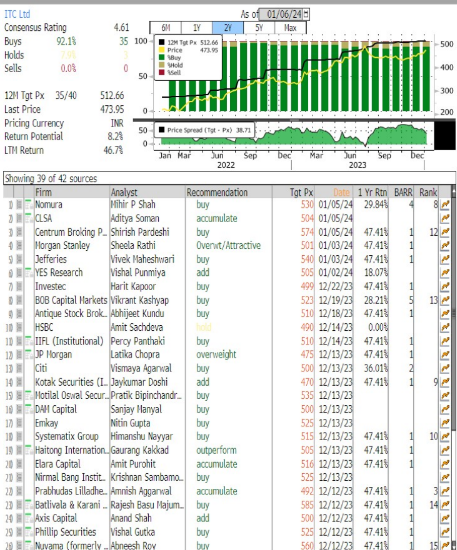

Recommendation

Detailed Analysis

ReplyDeleteGreat work

ReplyDeleteAmazing write up

ReplyDeleteGood read! Great work

ReplyDeleteGood read

ReplyDeletenice!

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGreat analysis...!

ReplyDeleteInsightful Information

ReplyDeletevery uselful info

ReplyDeleteNice analysis

ReplyDeleteVery useful insights for a potential investor

ReplyDeleteVery informative

ReplyDeletegood one

ReplyDeleteexcellent work

ReplyDeleteDetailed and Informative analysis, useful for long term investors

ReplyDeleteVery useful insights. Great work

ReplyDeleteA very detailed analysis covering both quantitative and qualitative aspects of ITC

ReplyDelete